vermont income tax withholding

If you want even more control over your tax withholding you can also specify a dollar amount for your employer to withhold. W-2 and 1099 may be filed for 2018 on our online filing site atmyVTaxvermontgov.

Vermont Income Tax Vt State Tax Calculator Community Tax

The BI-476 may be filed and the tax paid using myVTax our free secure online.

. February 25 2021 Effective. Determine the exemption allowance by applying the following guideline and subtract this amount from the annual wages to compute taxable income. Tax Rates and Charts Tuesday December 21 2021 - 1200.

GB-1210 - 2022 Income Tax Withholding Instructions Tables and Charts. Exemption Allowance 4000 x Number of Exemptions. The income tax withholding formula on supplemental wages for the State of Vermont includes the following changes.

However tax is due on the original due date. Vermont School District Codes. Vermont income tax rate.

No action on the part of the employee or the personnel office is necessary. Amount of Vermont income tax withholding reported during the year to the amount of withholding tax shown on the W-2 andor 1099 forms. To help employers calculate and withhold the right amount of tax the IRS and the Vermont Department of Taxes issues guides each year that include withholding charts and tables.

The annual amount per allowance has changed from 4350 to 4400. Divide the annual tax withholding by 26 to obtain the biweekly Vermont tax withholding. Exemption Allowance 4400 x Number of Exemptions.

The Single Head of Household and Married annual income tax withholding tables have changed. Apply the taxable income computed in step 5 to the following table to determine the annual Vermont tax withholding. PA-1 Special Power of Attorney.

Apply the taxable income computed in step 5 to the following table to determine the annual Vermont tax withholding. You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding. Form IN-151 - Application for.

The annual amount per exemption has increased from 4050 to 4250. Apply the taxable income computed in step 5 to the following table to determine the annual Vermont tax withholding. Business entities owned exclusively by Vermont residents with income and loss deriving only from Vermont may file the simplified form BI-476 Business Income Tax Return For Resident Only.

Form CO-411 Corporate Income Tax Return is due on the date prescribed for filing under the Internal Revenue Code. An extension of time to file a federal return automatically extends the time to file with Vermont until 30 days beyond the federal extension date. These forms help your employer calculate how much income tax to withhold and pay from each paycheck.

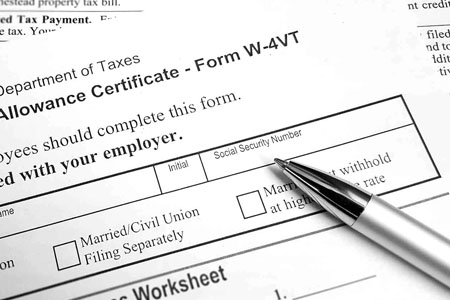

Census Bureau Number of cities with local income taxes. If Federal exemptions were used and there are additional Federal withholdings proceed to step 8. Once the employer has the information youve entered on forms W-4 and W-4VT the employer is able to calculate your withholding tax.

The commissioner of taxes has mandated the electronic. The annual amount per allowance has changed from 4400 to 4500. Because the federal and Vermont income tax calculations differ.

The income tax withholding for the State of Vermont includes the following changes. Form WHT-434 and Forms. The Vermont minimum entity tax of 250 must be paid with the return.

Pay Period 03 2019. The income tax withholding for the State of Vermont includes the following changes. No action on the part of the employee or the personnel office is necessary.

For example if you want your employer to withhold an additional 20 from. Determine the exemption allowance by applying the following guideline and subtract this amount from the annual wages to compute taxable income. The income tax withholding for the State of Vermont includes the following changes.

W-4VT Employees Withholding Allowance Certificate. Exemption Allowance 4500 x Number of Exemptions. IN-111 Vermont Income Tax Return.

The Single or Head of Household and Married income tax withholding tables have changed. Estimated tax payments must be sent to the Vermont Department of Taxes on a quarterly basis. The annual amount per exemption has increased from 4250 to 4350.

March 8 2019 Effective. TAXES 21-10 Vermont State Income Tax Withholding. The Vermont income tax has four tax brackets with a maximum marginal income tax of 875 as of 2022.

Determine the exemption allowance by applying the following guideline and subtract this amount from the annual wages to compute taxable income. The Single or Head of Household and Married income tax withholding tables have changed. Ad The Leading Online Publisher of National and State-specific Legal Documents.

When you start a new job your employer will ask you to complete a federal Form W-4 the Employees Withholding Allowance Certificate and a Form W-4VT for Vermont withholding. Get Access to the Largest Online Library of Legal Forms for Any State. TAXES 19-23 Vermont State Income Tax Withholding.

Vermont Income Tax Vt State Tax Calculator Community Tax

File A New Vermont W 4vt Department Of Taxes

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Vermont Income Tax Vt State Tax Calculator Community Tax

State Income Tax Withholding Considerations A Better Way To Blog Paymaster

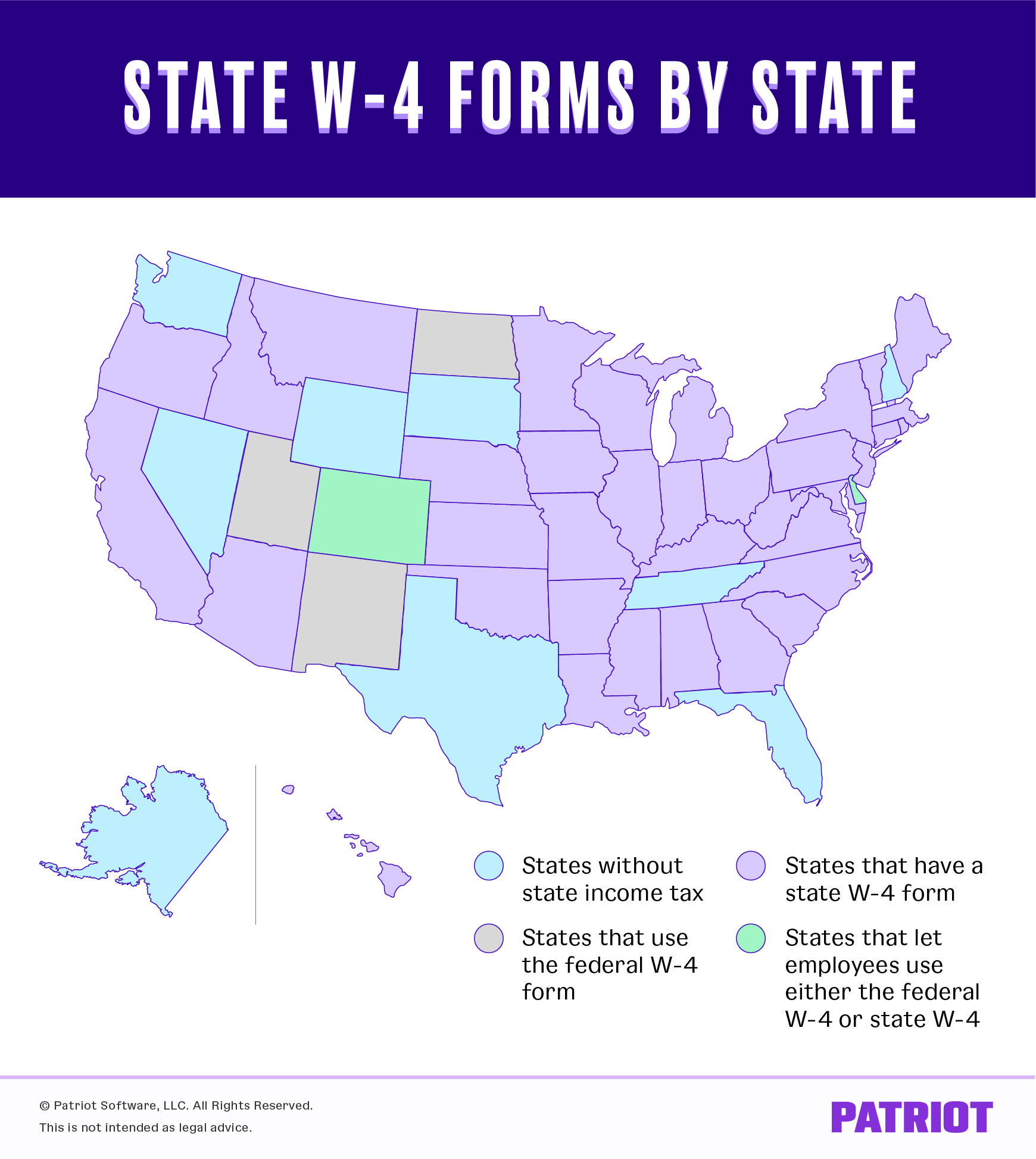

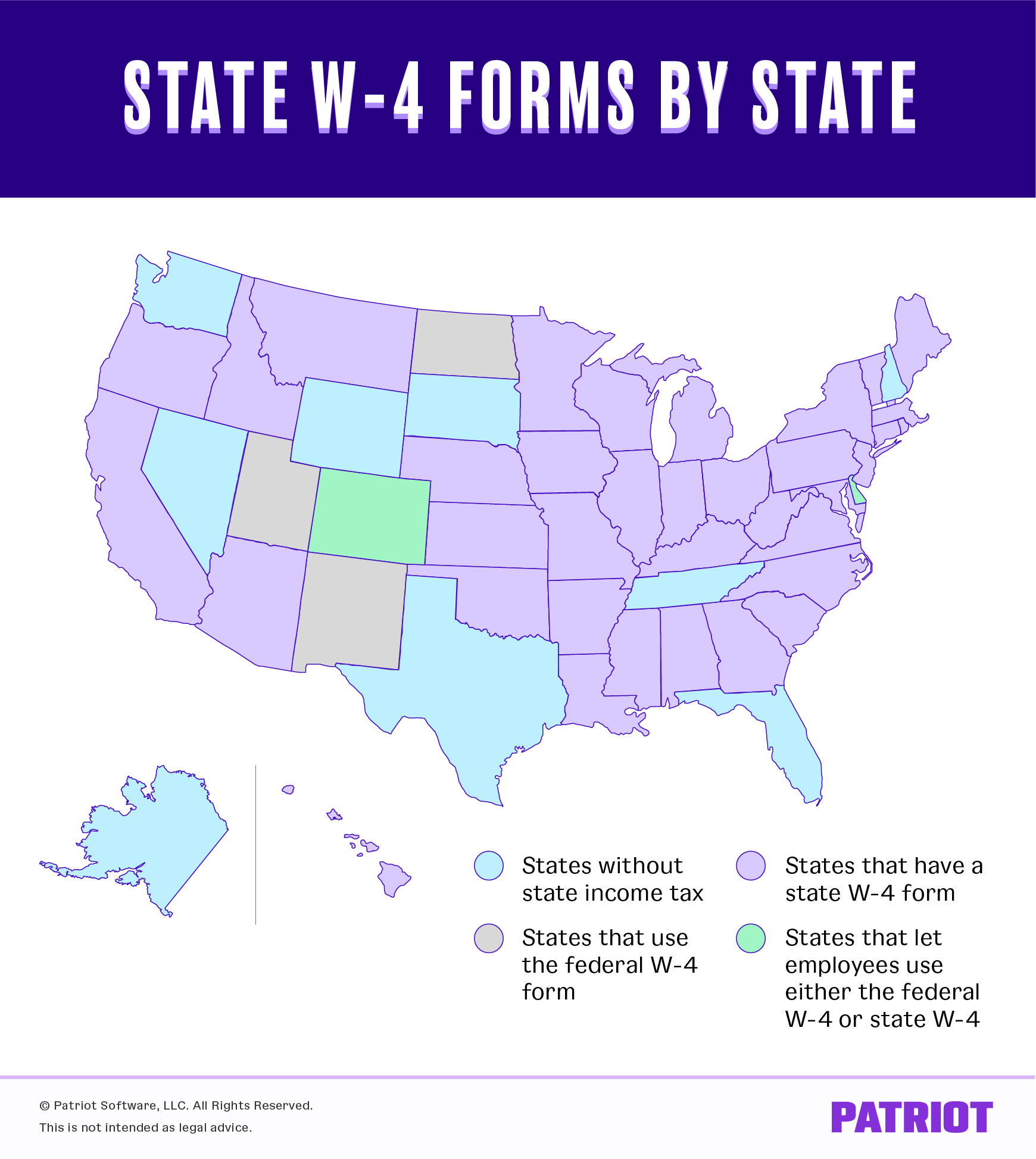

State W 4 Form Detailed Withholding Forms By State Chart

Vermont Income Tax Vt State Tax Calculator Community Tax

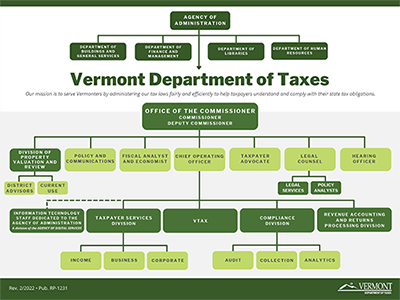

Organization Department Of Taxes

State W 4 Form Detailed Withholding Forms By State Chart

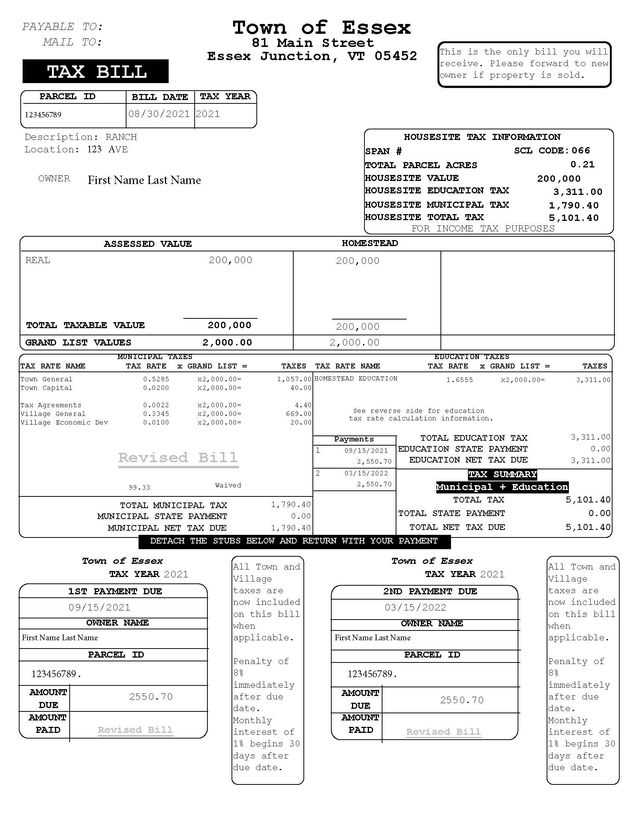

Real Estate Taxes Burlington Vt Peet Law Group

Small Business Guide Different Types Of Accounting Services That You May Need Fincyte Business Tax Tax Software Accounting

Vermont Income Tax Vt State Tax Calculator Community Tax

Personal Income Tax Department Of Taxes

State Income Tax Rates Highest Lowest 2021 Changes