tax sheltered annuity vs 401k

An annuity is not tax-deductible. The terms tax-sheltered annuity and 403b are often used interchangeably.

Cno Financial Group On Twitter Do You Know The Difference Between An Annuity An Ira And A 401k During Annuity Awareness Month Learn How To Distinguish Between Each Of These Retirement Tools

An annuity is an insurance product.

. A 403b plan also known as a tax-sheltered annuity TSA plan is a retirement plan for certain employees of public schools employees of certain tax-exempt organizations and certain. Its similar to a 401k plan maintained by a for-profit entity. It offers a double tax benefit.

Taxes need not be paid. Here are the pros cons and differences between the two. Contribution limits for a 403b.

A 403b plan is also another name for a tax-sheltered annuity plan and the features of a 403b plan are comparable to those found in a 401k plan. A 403b plan or tax. A tax-sheltered investment is an asset or a portfolio of assets that is purchased or structured to reduce your income tax liabilities in a legal way.

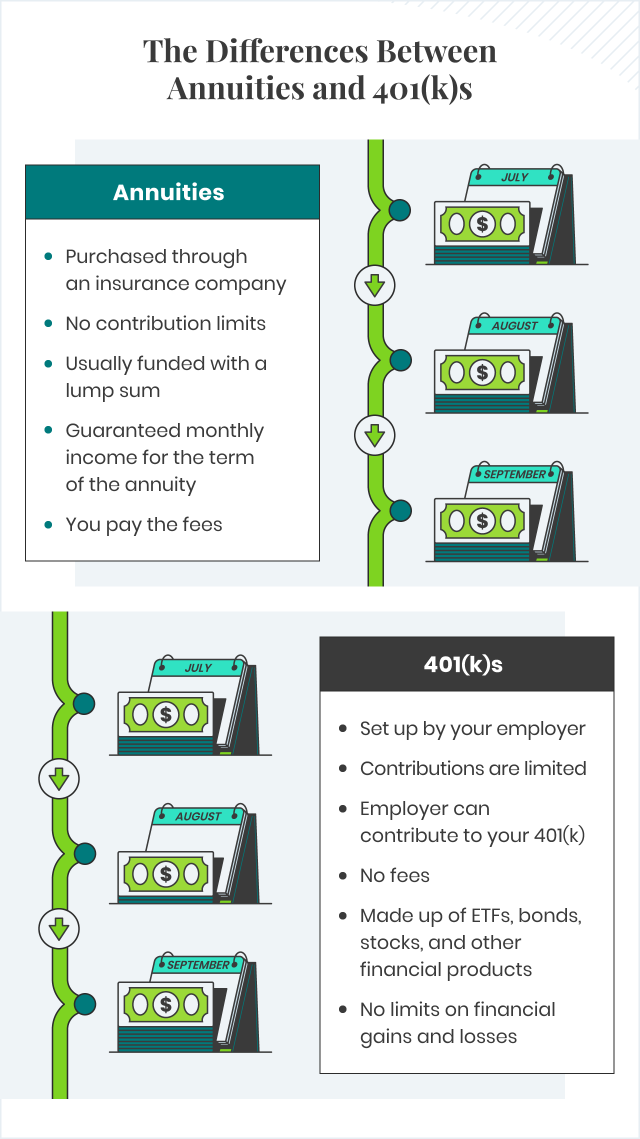

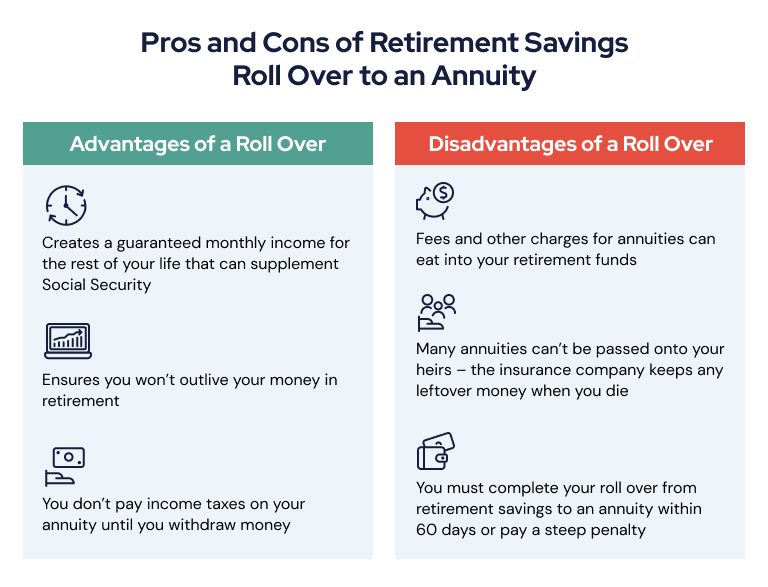

A 403 b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501 c 3 tax-exempt organizations. A Roth IRA is a retirement plan. Both annuities and 401 ks provide a tax-sheltered way to save for retirement.

Tax-exempt nonprofit organizations have a choice between offering a 403b a 401k or both. A tax-sheltered annuityalso known as a 403 b plan or a TSA planis a type of retirement plan only offered by certain 501 c 3 tax-exempt organizations such as charities. These plans tend to be offered by public schools and some nonprofits.

When the 403b was created in 1958 it was known as a tax-sheltered annuity as it only offered annuities. 401k is a retirement product or plan offered by the employer. An annuity is an investment vehicle with tax-deferred growth.

Tax Sheltered Annuity Plans. Just as with a. A 403b plan tax-sheltered annuity plan or TSA is a retirement plan offered by public schools and certain charities.

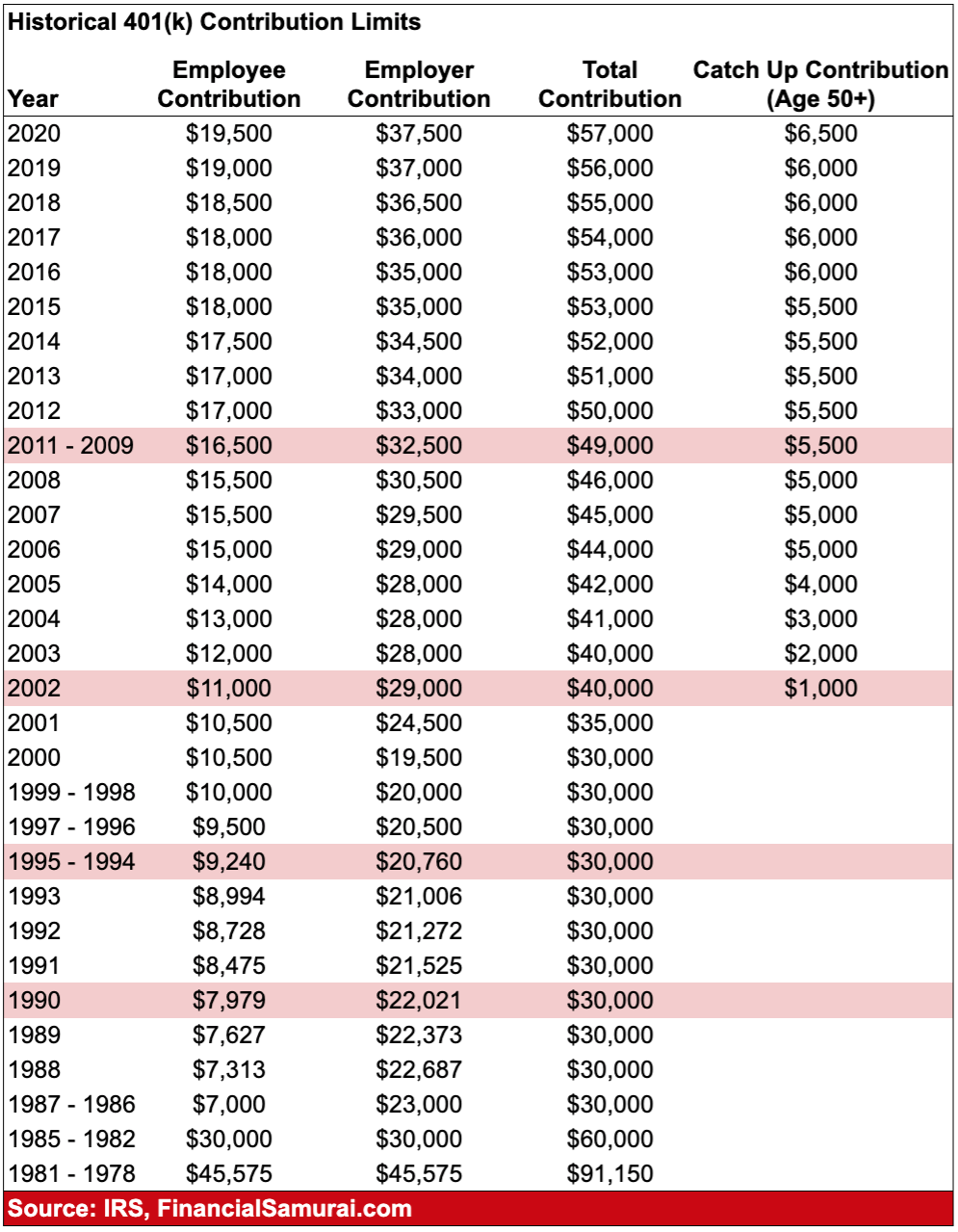

You only pay taxes on the growth when you remove the funds. A tax-sheltered annuity TSA is a retirement savings plan that allows employees to invest pre-tax dollars in an account to build retirement income. For 401k plans the total contribution limit including catch-up contributions is 64500 for 2021 and 67500 for 2022.

A 403b plan is also known as a tax-sheltered annuity or TSA plan. You will not owe income taxes on the investment returns of a 401 k or annuity until you. Although 401k plans are the most popular an alternative known as a tax-sheltered annuity or TSA plan is available to many workers especially in the nonprofit world.

401 K Vs 403b Chapter 7 What Is A 403b Vs 401 K Intuit Mint

Should I Buy An Annuity From My 401 K 2022

What Are The Benefits Of Having 401 K Plan

Annuity Vs 401 K Which Is Best For My Retirement

Here S When You Ll Become A 401k Millionaire Financial Samurai

Can I Buy An Annuity With My Ira Or 401k Immediateannuities Com

2022 2023 401k 403b 457 Ira Fsa Hsa Contribution Limits

Should I Buy An Annuity From My 401 K 2022

How To Roll Your Ira Or 401 K Into An Annuity

457 B Vs Roth Ira Why You Might Opt For A 457 B Seeking Alpha

Annuity Taxation How Various Annuities Are Taxed

Here S When You Ll Become A 401k Millionaire Financial Samurai

What S The Difference Between 401 K And 403 B Retirement Plans

403 B Vs 401 K What S The Difference How Are They The Same

/retirement_plans-5bfc3081c9e77c0026b5e754.jpg)

The Pros And Cons Of Annuities

403 B Vs 401 K Comparison Pros Cons Examples

403 B Vs 401 K What S The Difference How Are They The Same